Private Equity M&A: Market Dynamics, Deal Structuring, and Risk Management

Elena advises public and private companies, including private equity and infrastructure funds and other investors, on corporate and business combination transactions such as mergers, acquisitions, divestitures, investments, co-investments, joint ventures, recapitalizations, restructurings, and bankruptcy sales.

Drawing on over a decade of experience, Vinita advises corporate and private equity clients on domestic and cross-border transactions. including mergers, acquisitions and sales of companies and businesses, consortium transactions, joint ventures, investments, management rollovers, and reorganizations.

2 hour CLE

Get this course, plus over 1,000+ live webinars.

Learn More

Program Summary

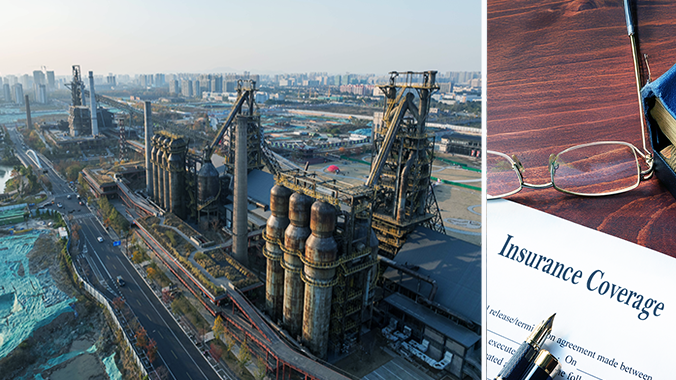

Private equity M&A transactions require careful structuring, strategic negotiation, and effective risk management to ensure successful outcomes for all parties involved. This program will provide a deep dive into the critical deal terms shaping today’s transactions, from market dynamics and valuation trends to financial structuring and risk allocation. Attendees will explore key negotiation strategies for buyers and sellers, including rollover equity, growth-through acquisition approaches, earnouts, and seller financing. The discussion will also cover essential risk mitigation tools such as representation and warranty insurance, indemnification strategies, and reverse break-up fees. Finally, participants will gain insights into navigating competitive bidding scenarios, optimizing due diligence, and overcoming execution challenges to close deals with confidence.

This course is co-sponsored with myLawCLE.

Key topics to be discussed:

- Market dynamics shaping private equity M&A

- Structuring deals for success: Key considerations

- Negotiating financial terms and risk allocation

- Risk management in private equity transactions

![]() Closed-captioning available

Closed-captioning available

Speakers

Elena Rubinov | Linklaters New York

Elena Rubinov | Linklaters New York

Elena advises public and private companies, including private equity and infrastructure funds and other investors, on corporate and business combination transactions such as mergers, acquisitions, divestitures, investments, co-investments, joint ventures, recapitalizations, restructurings, and bankruptcy sales.

She also advises clients on debt and corporate restructurings in connection with equity recapitalizations, rights offerings, and 363 sales and acquisitions.

She is ranked in Energy Transactions categories by both Chambers (USA and Global) and Legal 500 U.S., and is named a Rising Star Partner for M&A in the IFLR1000 Financial & Corporate Guide.

Vinita Sithapathy | Linklaters New York

Vinita Sithapathy | Linklaters New York

Drawing on over a decade of experience, Vinita advises corporate and private equity clients on domestic and cross-border transactions. including mergers, acquisitions and sales of companies and businesses, consortium transactions, joint ventures, investments, management rollovers, and reorganizations.

She has experience working in a range of sectors including technology, infrastructure, energy, asset management, life sciences, food and agriculture, manufacturing and consumer goods

Agenda

I. Market dynamics shaping private equity M&A | 1:00pm – 1:30pm

- Factors driving deal activity and valuation trends

- Emerging structures and strategies shaping transactions

II. Structuring deals for success: Key considerations | 1:30pm – 2:00pm

- Transaction structures available

- Aligning buyer and seller interests in transaction structures

Break | 2:00pm – 2:10pm

III. Negotiating financial terms and risk allocation | 2:10pm – 2:40pm

- Impact of deal dynamics on risk management considerations

- Leveraging representation and warranty insurance effectively

- Key indemnification considerations and strategies

IV. Risk management in private equity transactions | 2:40pm – 3:10pm

- Managing multiple bidders and competitive sale processes

- Due diligence strategies to enhance deal certainty and value

- Tactics for minimizing execution risks and ensuring smooth closings

Preview

More CLE Webinars

Trending CLE Webinars

Upcoming CLE Webinars

![Attorney–Client Privilege and Work Product: Managing Waiver Risk, Internal Investigations, Regulatory Scrutiny, and Third-Party Communications (2026 Edition) [Includes 1 Ethics hour]](https://miamidadebarcle.org/wp-content/uploads/2026/01/Product_img_-Attorney–Client-Privilege-and-Work-Product.jpg)